The public sector and International Financial Institutions (IFI) seek to be knowledge and learning organizations. Yet, just like corporations and enterprises, they struggle.

Implementing the right technology to maximize the value of thousands of research, lessons learned and experience amassed for the past few decades is still a huge gap unfulfilled.

For example, in 2017 alone, the IFI, Asian Development Bank (ADB), released on its 2017 Annual Evaluation Review that 60 percent of ADB staff surveyed said finding recommendations from completed projects are difficult.

Respondents call for a knowledge database that has a better capability for meta-analysis, lesson synthesizing and search.

The need to innovate

Yet, the call for innovation in both IFIs and public sector is double-bind. Jon Simonsson, Head of Innovation, Research, and Capital at Sweden’s Ministry for Enterprise and Innovation said:

The political incentives to risk public money are non-existent – it’s too easy to see the short-term political consequences of initiatives gone wrong and debate whether taxpayers’ money is going down the drain. Public money is to be spent according to rules and regulations.

The double-bind problem of IFIs and the public sector is a paradox. They are risk-averse, yet they need to innovate. In a macro perspective, these institutions do not differ from their corporate counterparts.

The world of VUCA

Just like enterprises, IFIs and the public sector navigate in a world of volatility, uncertainty, complexity, and ambiguity, otherwise known as VUCA.

The world of VUCA causes an efficiency gap that only innovation can solve. To be innovative means to take more risk. A fail fast, fail early approach is the only way to bring a culture of innovation and technological advancement to financial institutions and the government.

Business Intelligence is dead

The days of the good old business intelligence platform is dead. With the growing disparate data sources and fragmented knowledge management platforms, there is a need for IFIs to abandon the old ways of working.

Big data and artificial intelligence should be the backbone of knowledge and data systems, to transform institutions to a data-driven enterprise, maximizing the value it has amassed throughout the years.

Artificial Intelligence for IFIs and the Public Sector

The AI landscape is huge. A careful selection of a technology fit for purpose is key to a successful pilot AI. Where should IFIs and the public-sector start? Here’s the topmost three:

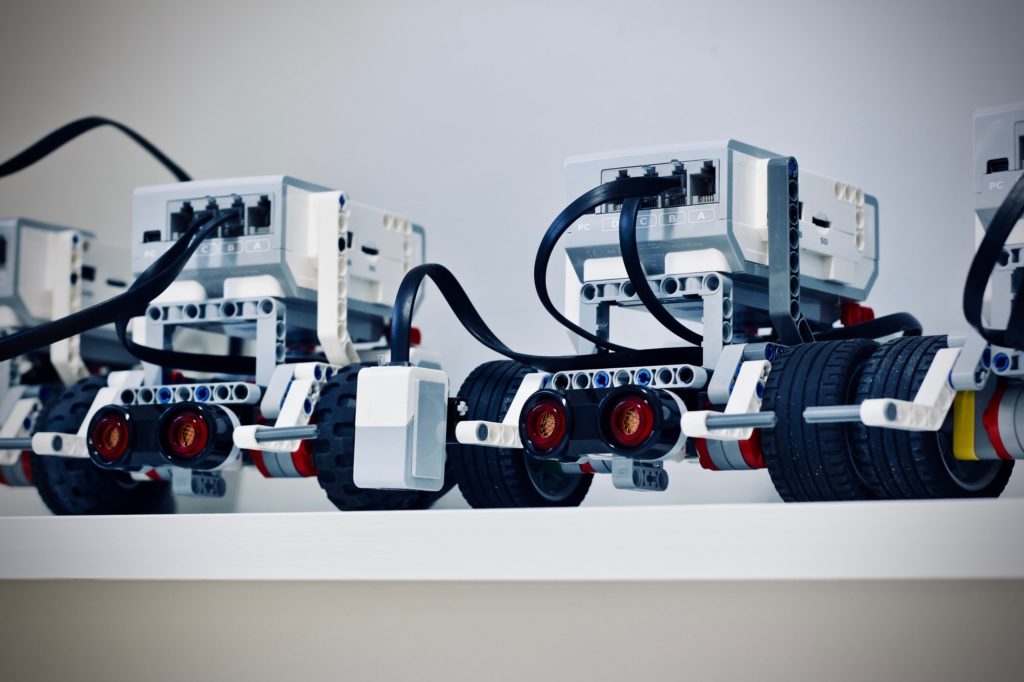

Robotic Process Automation (RPA)

Digitizing core business or government operations is no easy feat. Aside from technical ambiguity, siloed implementation and unclear expectations further add to the toll.

How does it work

Robotic Process Automation (RPA) are software robots that can run transactional and rule-based tasks through copying user behavior. The technology can automate high-volume and transactional processes. RPA products such as WorkFusion Smart Process Automation (SPA) is an enterprise software that allows integration of core systems and transaction automation.

Application

When applied in IFIs and the public sector, it can improve efficiency by automating repetitive work through AI. This, in turn, allows organizations to focus on tactical priorities WorkFusion (SPA) can end recurring pain-points. For example, frequent policy changes that need business process integration can be taken-cared of by WorkFusion SPA instead of a human. In effect, policy execution becomes faster, consistent, predictable and less prone to error.

Text Mining and Natural Language Processing (NLP)

Text mining is the process of extracting valuable information and knowledge from unstructured data.

Financial institutions and governments have a tremendous wealth of knowledge. Buried in project documents, research and content. These are all unstructured text that a typical data mining process cannot handle.

How does it work

Unlike data mining which is typical of business intelligence applications, text mining can deal with both unstructured and semi-structured data.

Text documents, HTML tables, and emails are just a few examples. Text mining allows for statistical and machine learning algorithm interpretations. This, in turn, could analyze thousands of unstructured word clusters and derive relevant summaries that could drive the success of future projects.

Application

Text mining, when combined with NLP, can help IFIs and the public sector make sense of thousands, even millions of unstructured data. Emails, presentations, memos, and speeches archived for the past few years, even decades can be ingested to derive knowledge and insight that are key data-driven decision making.

Deep Learning

Closely related to human brain development is deep learning. Unlike task-specific algorithms like RPA, deep learning models work like a biological nervous system.

How does it work

In deep learning, computers are taught to learn by example. It is the tech behind self-driving cars, voice recognition, image recognition and natural language processing. By utilizing neural network architectures patterned from the brain, deep learning eliminates the need for human training.

For example, deep neural networks such as convolutional neural networks (CNN) can process images on its own. Unlike machine learning, it doesn’t need manual feature extraction to classify images.

Application

The model learns as it collects images, eliminating the need human-aided pre-training. IFIs and the public sector can use deep learning to analyze its financial statements, annual reports, and project evaluation reports.

Any document that typically takes three or more days to review can be analyzed in just a matter of seconds. Deep learning models can do this by mimicking the thought process of subject matter experts, consultants and analysts.

Take action

IFIs and the public sector seek to be a knowledge and learning organization. Yet, the risk-averse and conservative nature of these institutions causes slow technology adoption.

However, the world of volatility, uncertainty, complexity, and uncertainty doesn’t tolerate inaction. A fail-fast fail early approach is the middle ground between innovation and small risk appetite. IFIs and the public sector should start small and scale up. Not in a five or seven-year horizon, but today.